Platinum Wealth Partners’ Insights

There are tipping point indicators in any directions you care to explore. Stock markets are being crushed, economies are heading towards long slumps, Europe faces a migration crisis, technology doesn't help, and moreover - everyone is becoming poorer.

A deeper look into these indicators and many more; suggests we are operating beyond the planet's physical capacities and the constraints imposed by limits to growth.

August 27, 2015

Real Household Net Worth:

Look Out Below?

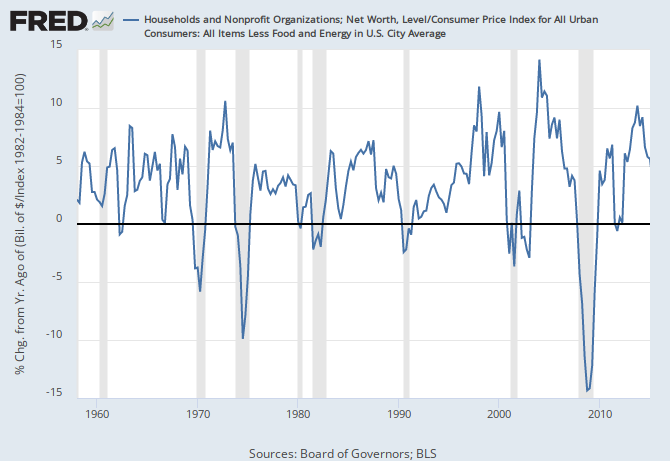

In my last post I pointed out that over the last half century, every time the year-over-year change in Real Household Net Worth went negative (real household wealth decreased), a recession had either started, or was about to. (One bare exception: a tiny decline in Q4 2011, which looks rather like turbulence following The Big Whatever.) Throughout, click for source. -

The problem: we don’t see this quarterly number until three+ months after the end of a quarter, when the Fed releases its Z.1 report for the the preceding quarter. The Q2 2015 report is due September 18.

But right now we might be able to roughly predict what we’re going to see four+ months from now, in the report on our current quarter, Q3, which ends September 30. We’re a bit over a month from the end the quarter, and we have some numbers to hand.

The U.S. equity markets are down roughly 7% year-over-year

South Africa's economy contracts, risk of recession grows

PRETORIA (Reuters) - South Africa's economy shrank for the first time in more than a year during the second quarter of 2015, raising the risk that labour disputes and slowing Chinese demand for commodities could push it towards recession.

The economic strain will inhibit the central bank from raising rates further to protect a weak currency and target inflation, while also torpedoing government efforts to keep deficits in check and protect its credit ratings.

A record 107,500 migrants crossed the EU borders last month to outstrip the previous monthly record in June of 70,000. During the first seven months there were nearly 340,000 migrants, up from 123,500 last year,

Warring Migrant Tribes, Grenade Attacks…What Is Going On In Sweden?

if you bring intolerant people into your country this is what can happen

Not only how we deal with the world and make sense of it, or interact with each other, but also how we look at ourselves and understand our own nature, existence, and responsibilities.

This is the IT version of my book The Great Field (available in Kindle books).

$2.1 Trillion Erased From U.S. Stocks In Six Days

The enormous losses reflect the deep fears gripping markets about how the world economy will fare amid a deepening economic slowdown in China.

The Dow, S&P 500 and Nasdaq have all tumbled into correction territory, their first such 10% decline from a recent high since 2011.

The S&P 500 -- the best barometer for the biggest U.S. companies -- has lost trillions of market value in the six-day selloff through Tuesday, according to S&P Dow Jones Indices.

To put those losses into perspective, that's roughly equal to the combined market value of these corporate titans put together:

Apple (AAPL, Tech30), Google(GOOGL, Tech30), Berkshire Hathaway (BRKA), ExxonMobil (XOM), Facebook (FB, Tech30), Walmart(WMT) and 21st Century Fox (FOXA).

Originally Published